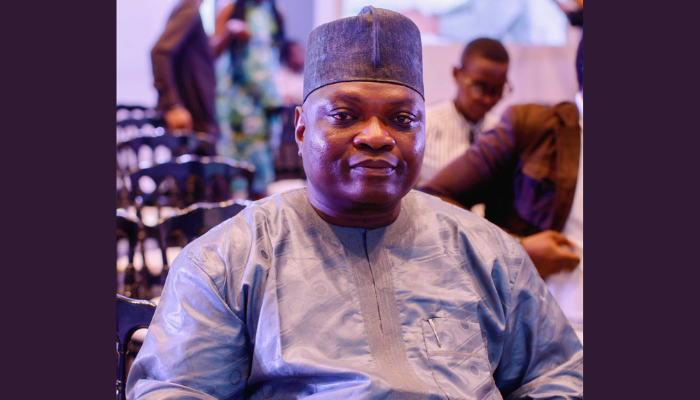

Femi Egbesola, National President of the Association of Small Business Owners of Nigeria (ASBON), has called on entrepreneurs to take advantage of government-backed programmes designed to expand access to finance, improve business credibility and strengthen the global position of local enterprises.

He gave the charge at the BusinessDay Top 100 Fastest Growing SMEs in Nigeria Awards, where he said small firms must meet global standards to compete in wider markets. According to him, “competitiveness goes beyond ambition” and requires alignment with international benchmarks in pricing, quality, consistency, reliability, branding and integrity.

Read also: Experts say MSMEs must build systems, data and governance to scale

New financing windows and policy instruments

Egbesola outlined a set of new policy tools and financial interventions released by the government and regulatory bodies to support growth among small firms.

One of the instruments is the recent approval of three crowdfunding platforms by the Securities and Exchange Commission (SEC). These platforms allow businesses to raise capital from multiple investors with low documentation and flexible terms.

He also noted the Nigerian Stock Exchange (NSE) Growth Board, which gives limited liability companies the option to list, gain visibility and raise funds from a wider class of investors.

To ease access to credit, Egbesola pointed to the National Credit Guarantee Company, launched in mid-2025, which covers up to 70 per cent of bank loans for small businesses. The guarantee lowers collateral requirements and is expected to encourage banks to lend more to smaller firms.

Read also: BII, FCMB launch $50m facility to boost MSME growth in Northern Nigeria

He added that more factoring companies now help enterprises receive early payment for invoices, reducing waiting times from large corporations and government agencies. In the same way, leasing providers are offering machinery, vehicles and generators on long-term payment plans, reducing pressure on owners who rely on expensive bank loans.

On regional trade, he said the government is working under the AfCFTA framework to support export expansion. Specific products have been marked as export-ready and will receive funding and grants from 2026. He urged entrepreneurs to study these sectors and position their firms.

Egbesola also warned firms to protect their brands. He cited a pepper brand that lost ownership in foreign markets due to failure to secure trademark rights.

He highlighted the National Single Window Portal, which now supports customs, immigration and certification processes in one place. The shift aims to cut delays in export documentation and reduce room for unofficial payments.

Egbesola listed new intervention funds such as the Rural Area Program on Investment for Development, which offers up to N10 million at 5 per cent interest; WomenGLOBE, which provides up to N50 million for women-led firms at 7 per cent; the Youth Entrepreneurship Program Fund for youth-owned ventures; and AgriFund for agriculture and agri-processing.

Read also: MTN, SMEDAN partner to strengthen Nigeria’s SME ecosystem

Policies, certifications and structures shaping SME growth

Looking ahead, he advised SMEs to follow two policy documents currently being finalised: the National Industrial Policy and the National MSME Policy (2026–2030). These policies will set the direction for funding, value addition, automation and regulatory requirements.

He added that business owners should secure the Business Integrity Certification from the Financial Reporting Council. The certification is free until March 2026 and will soon be a requirement for inclusion in major supply chains.

Read also: GIBC, Trade Lenda unveil N15bn SME growth fund ahead 2025 impact conference

Other support structures include Small Claims Courts, which handle financial disputes within short timelines, shared industrial centres, incubators and procurement rules that reserve 40 per cent of government contracts for SMEs.

Egbesola said SMEs must be deliberate in studying the landscape. According to him, “competitiveness is about following the order of the day”, and small firms can scale if they embrace structure, innovation and the support programmes now in place.